What is Binance Private Placement? A Comprehensive Guide to Exchange Investment Opportunities

In the dynamic world of cryptocurrency, terms like "Binance exchange private placement" often surface, sparking curiosity among investors. This concept represents a unique gateway to early-stage investment opportunities within one of the world's leading digital asset ecosystems. For anyone looking to diversify their crypto portfolio beyond public market trading, understanding the mechanics, benefits, and considerations of Binance's private placement offerings is crucial. This guide provides a broad overview, demystifying the process and exploring its role in the broader virtual currency landscape.

Demystifying Binance Private Placement: Beyond the Public Market

At its core, a Binance private placement refers to a fundraising method where Binance, the exchange, offers new tokens or investment opportunities to a select group of investors before they are listed on the public trading platform. Unlike an Initial Coin Offering (ICO) or Initial Exchange Offering (IEO) that may be open to the general public, private placements are typically restricted to accredited investors, venture capital firms, institutional investors, or sometimes select users from the Binance Launchpool. This model allows projects to secure substantial funding and strategic partnerships with established players in the crypto space, ensuring a stronger foundation before facing the volatility of the open market.

How Does the Binance Private Placement Process Work?

The process is designed to be exclusive and strategic. It usually begins with Binance's investment arm, Binance Labs, or its listing team identifying promising blockchain projects with high growth potential. These projects could be in sectors like DeFi (Decentralized Finance), GameFi, Web3 infrastructure, or novel Layer 1 blockchains. Selected investors are then invited to participate in a closed funding round. The terms, including token price, vesting schedules (lock-up periods), and minimum investment amounts, are negotiated privately. This early access often comes at a discounted price compared to the anticipated public listing price, offering a potential upside for participants who are willing to accept the higher risk associated with early-stage ventures.

Key Benefits for Projects and Investors

For blockchain startups, a Binance private placement is more than just capital. It provides instant credibility, access to Binance's vast ecosystem, and expert mentorship. The association with a top-tier exchange can be a powerful catalyst for growth. For investors, the primary allure is the opportunity to get in on the ground floor of potentially transformative projects. It allows for portfolio diversification into pre-listed assets and the chance to build strategic, long-term holdings. Furthermore, participating in these rounds can foster closer relationships with the Binance ecosystem, potentially opening doors to future exclusive opportunities.

Risks and Important Considerations to Weigh

While the potential rewards are significant, Binance private placement investments carry substantial risk. The most prominent is the high risk of project failure, common in the nascent crypto industry. The illiquid nature of these investments is another critical factor; tokens are typically subject to a vesting period ranging from several months to years, during which they cannot be sold. Investors must also conduct thorough due diligence, as the information available may be limited compared to publicly listed companies. Regulatory uncertainty across different jurisdictions adds another layer of complexity, and the discounted entry price is not a guarantee of future profits once the token hits the public market.

SEO Keywords and Long-Tail Search Phrases in Context

For users researching this topic, search patterns vary widely. Common related searches include "how to join Binance private sale," "Binance Labs investment portfolio," and "benefits of pre-listing crypto investments." Long-tail keywords such as "risks of participating in a Binance private token sale," "Binance Launchpool vs private placement," and "what is the vesting period for Binance private placements" reflect deeper, more specific user intent. Understanding these phrases helps paint a complete picture of investor concerns, from entry mechanisms and comparative analysis to crucial risk factors like liquidity locks.

Binance Private Placement in the Evolving Crypto Ecosystem

Binance's private placement activities are a barometer for trends within the virtual currency sector. The focus of these investments often signals where Binance believes the next wave of innovation will occur, whether it was in DeFi protocols in 2020-2021 or in infrastructure and gaming projects more recently. For the broader market, successful private placements can lead to highly anticipated public listings, driving excitement and trading volume on the Binance exchange. They represent a vital channel of capital formation in the crypto economy, bridging innovative projects with the resources needed to scale.

Conclusion: Is Binance Private Placement Right for You?

Binance exchange private placement offers a compelling but complex avenue for sophisticated investors seeking early exposure to promising crypto ventures. It embodies a blend of high-risk, high-reward investing with the strategic backing of a leading industry player. For the average retail investor, these opportunities are often out of reach due to high capital requirements and accreditation barriers. However, understanding their existence and function is key to grasping the full lifecycle of a crypto project—from private funding to public listing. As with all cryptocurrency investments, thorough research, a clear assessment of personal risk tolerance, and an understanding of the illiquid, long-term nature of such commitments are absolutely essential before considering participation.

“What is Binance Private Placement? A Comprehensive Guide to Exchange Investment Opportunities” 的相关文章

RWA发射平台OreNet:OreNet的三重革命正在改写Web3规则

当全球600万亿真实资产还在链下沉睡,Web3的掘金者们已悄然启动「价值核武器」——RWA(真实世界资产)革命。OreNet,这个由香港RWA全球产业联盟背书的超级平台,正以「RWA+DePIN+DAO」的三重引擎,撕开传统金融与Web3的次元壁。一、RWA:被低估的万亿级价值黑洞传统金融体系中,房...

比特币“王座”松动;山寨币的春天真的要来了吗?

比特币“王座”松动:山寨币的春天真的要来了吗?加密货币市场 比特币 山寨币 以太坊 市场分析 投资趋势目录· 王座之争:比特币的统治力为何下降?· 山寨币的春天:指标与信号· 以太坊的领舞:谁将是下一个明星?· 市场的低语:机遇与风险并存· 季度展望...

WBS 币用途 - 全面解析这一新兴加密货币的多场景应用

WBS 币用途:全面解析这一新兴加密货币的多场景应用简介支付结算投资理财DeFi应用NFT与元宇宙未来发展WBS币简介WBS币(World Blockchain System Coin)是一种基于区块链技术的新型加密货币,近年来在数字资产领域崭露头角。作为一种去中心化的数字资产,WBS币不仅具备传统...

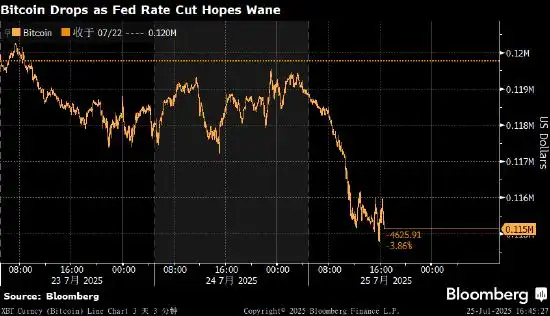

比特币走低 美国降息预期降温影响风险资产需求

全球第一大加密货币比特币价格周五走低,跟随风险资产整体跌势。对美联储降息的预期减弱,导致投资者风险偏好下降。 比特币跌至115,122美元,为7月11日以来最低水平。第二大加密货币以太坊下跌约3%,XRP下挫5.3%。 比特币在上周创下123,205美元的历史新高,驱动价格稳步上涨的因素包括对美...

比特币主导地位交易观点 | 加密货币市场周期分析与策略

比特币主导地位交易观点:解密加密货币市场周期更新时间:2025年7月27日 | 作者:加密货币市场分析师什么是比特币主导地位?比特币主导地位(Bitcoin Dominance, BTC.D)是指比特币市值占整个加密货币市场总市值的百分比。这一指标是衡量比特币相对于其他加密货币(山寨币)市场影响力的...

现货交流群:虚拟货币投资者的学习与分享平台

现货交流群:虚拟货币投资者的学习与分享平台什么是现货交流群?现货交流群是专注于虚拟货币现货交易的专业社群,为数字货币投资者提供实时市场分析、交易策略分享和投资经验交流的平台。在这个信息爆炸的时代,现货交流群帮助投资者筛选有价值的信息,避免市场噪音,提高投资决策质量。相关关键词: 数字货币交...