Is Binance Controlled by the Government? Unpacking the Facts and Rumors

In the volatile world of cryptocurrency, few questions spark as much debate and concern as the relationship between major exchanges and government bodies. "Has Binance been co-opted by the government?" is a query that echoes across online forums and investor circles. This article delves deep into the evidence, regulatory actions, and ongoing narratives to provide a clear overview of Binance's complex relationship with state powers, exploring everything from compliance agreements to conspiracy theories.

Understanding the "Co-option" Question in the Crypto World

When people ask if Binance has been "co-opted," they generally mean one of two things: either the exchange is now secretly controlled by a government agency, or it has been forced into such strict compliance that it effectively acts as an arm of the state. In the context of a globally decentralized vision like Bitcoin's, both scenarios are viewed with suspicion. To answer this, we need to look at the journey of Binance from a rebellious startup to a regulated financial entity, a path that has involved significant friction with governments worldwide.

The Regulatory Crackdown: Fines, Bans, and Compliance

The most direct evidence cited for government influence is the series of high-profile legal settlements Binance has entered. Most notably, its $4.3 billion settlement with U.S. authorities in 2023 was a watershed moment. The U.S. Department of Justice (DOJ) charged Binance with anti-money laundering failures and violations of sanctions laws. As part of the deal, Binance admitted to wrongdoing, paid a massive fine, and agreed to have an independent compliance monitor oversee its operations for several years. Founder Changpeng "CZ" Zhao also pleaded guilty and stepped down as CEO. This level of oversight is unprecedented for a crypto exchange and demonstrates a clear, enforced submission to U.S. government regulations, not a covert takeover.

Binance's Strategic Shift: From "Wild West" to Regulated Partner

Binance's early strategy could be described as "move fast and break things," often operating in regulatory gray areas. However, as the crypto industry matured, this approach became unsustainable. The company's current posture is one of active cooperation and compliance. It has significantly expanded its compliance team, implemented stricter Know Your Customer (KYC) procedures, and secured licenses in numerous jurisdictions like France, Dubai, and Japan. This strategic pivot from antagonist to regulated partner is a survival mechanism. For Binance to continue serving its massive user base, it must now play by the rules set by powerful government financial watchdogs.

The Rise of Conspiracy Theories and Market FUD

In the absence of perfect transparency, the crypto space is a fertile ground for Fear, Uncertainty, and Doubt (FUD). The 2023 DOJ settlement, combined with CZ's departure, fueled a wave of theories. Some speculate that the U.S. government now has a backdoor into Binance's systems, allowing for surveillance of user transactions. Others suggest the entire event was a controlled demolition to bring the world's largest crypto exchange to heel. While these theories are compelling narratives, they often lack verifiable evidence. They primarily serve as a reminder of the deep-seated distrust many in the community have toward centralized institutions, including the very exchanges they use.

Global Government Stances: A Patchwork of Influence

It's also misleading to speak of "the government" as a single entity. Binance's interactions vary dramatically by country. In the United States and the United Kingdom, the relationship has been defined by enforcement and strict oversight. In places like the United Arab Emirates and El Salvador, the relationship is more collaborative, with these governments embracing crypto innovation and Binance often playing a advisory role. This patchwork reality shows that Binance isn't being co-opted by a single global authority but is instead navigating a complex web of national interests and regulations, adapting its model to each local context.

What Does This Mean for User Privacy and Financial Freedom?

For the average user, the practical implications are significant. The era of anonymous, large-scale trading on Binance is over. Enhanced KYC and transaction monitoring mean that user activity is more transparent to regulators than ever before. This aligns with global efforts to combat illicit finance but undermines the privacy-centric ethos that initially attracted many to cryptocurrency. Your trading data and wallet addresses are now subject to the same scrutiny as traditional bank accounts in many jurisdictions where Binance operates legally.

Conclusion: Co-option or Necessary Evolution?

So, has Binance been co-opted by the government? The evidence points not to a shadowy takeover, but to a forced and very public maturation. Binance has been compelled to evolve from a decentralized-minded platform into a compliant global financial institution. The immense regulatory pressure has functionally made it an agent of state financial policy, particularly in enforcing anti-money laundering and sanctions laws. While this falls short of a secret government conspiracy, the result for users is similar: increased surveillance and control. The story of Binance is a case study in the inevitable clash between the libertarian ideals of crypto and the immutable reality of state power. For the ecosystem to survive and achieve mainstream adoption, this difficult reconciliation with regulation was, perhaps, always inevitable.

“Is Binance Controlled by the Government? Unpacking the Facts and Rumors” 的相关文章

R15_比特币;美国党的新基石

在瞬息万变的政治舞台上,特斯拉和 SpaceX 的首席执行官埃隆·马斯克再次以其惊人之举,投下了一枚重磅炸弹。他不仅宣布其新成立的“美国党”将把比特币(BTC)作为核心,更直言不讳地将法定货币斥为“无望”。这番言论如同一石激起千层浪,在加密货币社区和传统政界都引发了轩然大波。比特币:美国党的新基石故...

参与虚拟货币交易所推荐返佣,是否构成开设赌场罪帮助犯?

一、案情引入设定以下场景:A某是B交易所平台上的一名普通用户,B交易所是一家国际知名的数字货币交易平台,其总部位于境外,用户可以在平台上进行市场买卖、限价委托、市价委托以及止盈止损委托,也可以通过平台的杠杆服务实现对数字资产的杠杆交易,还可以通过平台的合约服务实现对数字资产衍生品的交易。最初,A某通...

数字资产对冲策略:全面指南与风险管理

数字资产对冲策略:全面指南与风险管理什么是对冲对冲策略对冲工具案例分析风险考量在高度波动的数字资产市场中,对冲策略已成为投资者保护资本的重要工具。本文将全面解析数字资产对冲的各种方法,帮助您在加密货币投资中有效管理风险。什么是数字资产对冲?数字资产对冲是指通过建立相反或相关的头寸,来抵消主要投资可能...

合约交易智能赔付:区块链技术下的自动化理赔新范式

合约交易智能赔付:区块链技术下的自动化理赔新范式概念解析运作机制核心优势应用场景面临挑战未来展望智能赔付的概念解析合约交易智能赔付是基于区块链智能合约技术的新型理赔系统,它通过预设条件和自动化执行机制,在满足特定触发条件时自动完成赔付流程。这一创新模式正在彻底改变传统保险和金融衍生品领域的理赔方式,...

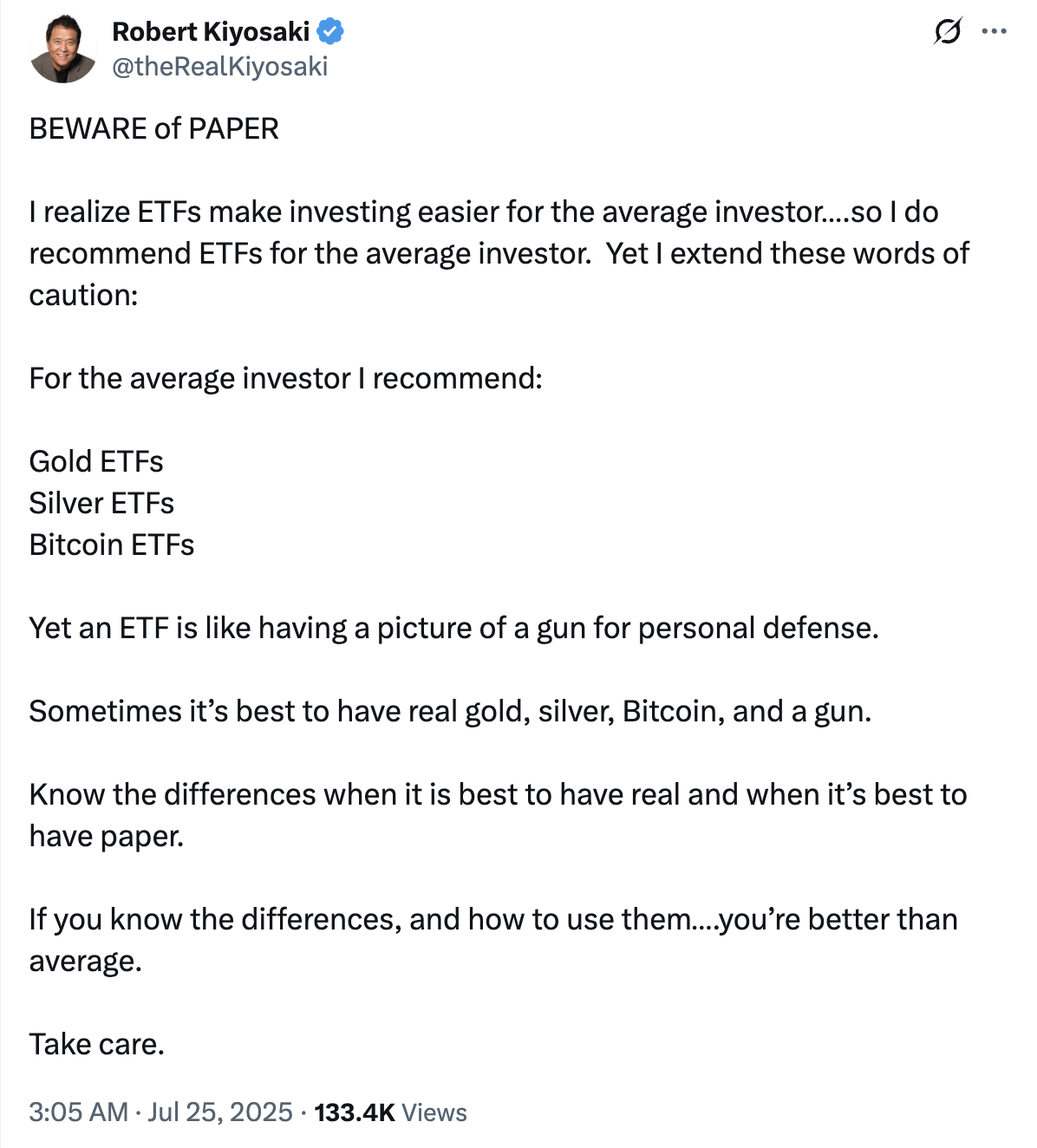

数字黄金的“纸”与“实”;清崎警告ETF风险,专家力证其安全性

数字黄金的“纸”与“实”:清崎警告ETF风险,专家力证其安全性标签: 罗伯特·清崎 比特币ETF 黄金 白银 实物资产 纸质资产 银行挤兑目录:· 序章:富爸爸的“枪支比喻”· 清崎的担忧:警惕“纸上财富”的幻象· 银行挤兑:一个古老的金融梦魇· ETF的防线...

欧易国内官方注册入口:合规指南与安全注册全流程

欧易国内官方注册入口:合规指南与安全注册全流程body { font-family: 'Microsoft YaHei', Arial, sans-serif; line-height: 1.6; color: #333;...